Employment Deductions 2025. We recommend that you use the payroll deductions online calculator (pdoc), the publication t4032 payroll deductions tables, or the publication t4008 payroll. Use the payroll deductions online calculator (pdoc) to calculate federal, provincial (except for quebec), and territorial payroll deductions.

Knowing the standard deduction amount for your filing status can help you determine whether you should take the standard deduction or itemize your deductions. The amt exemption rate is also subject to inflation.

Irs 2025 Standard Deductions And Tax Brackets Loni Marcela, Credits, deductions and income reported on other forms or schedules. Applying for an extension will give you until october 15, 2025 to file your returns.

SelfEmployment Tax Deductions and Benefits 2025 Abse Tax Service in Artesia, $50,000 x 92.35% = $46,175. A document published by the internal revenue service (irs) that provides information on how taxpayers who.

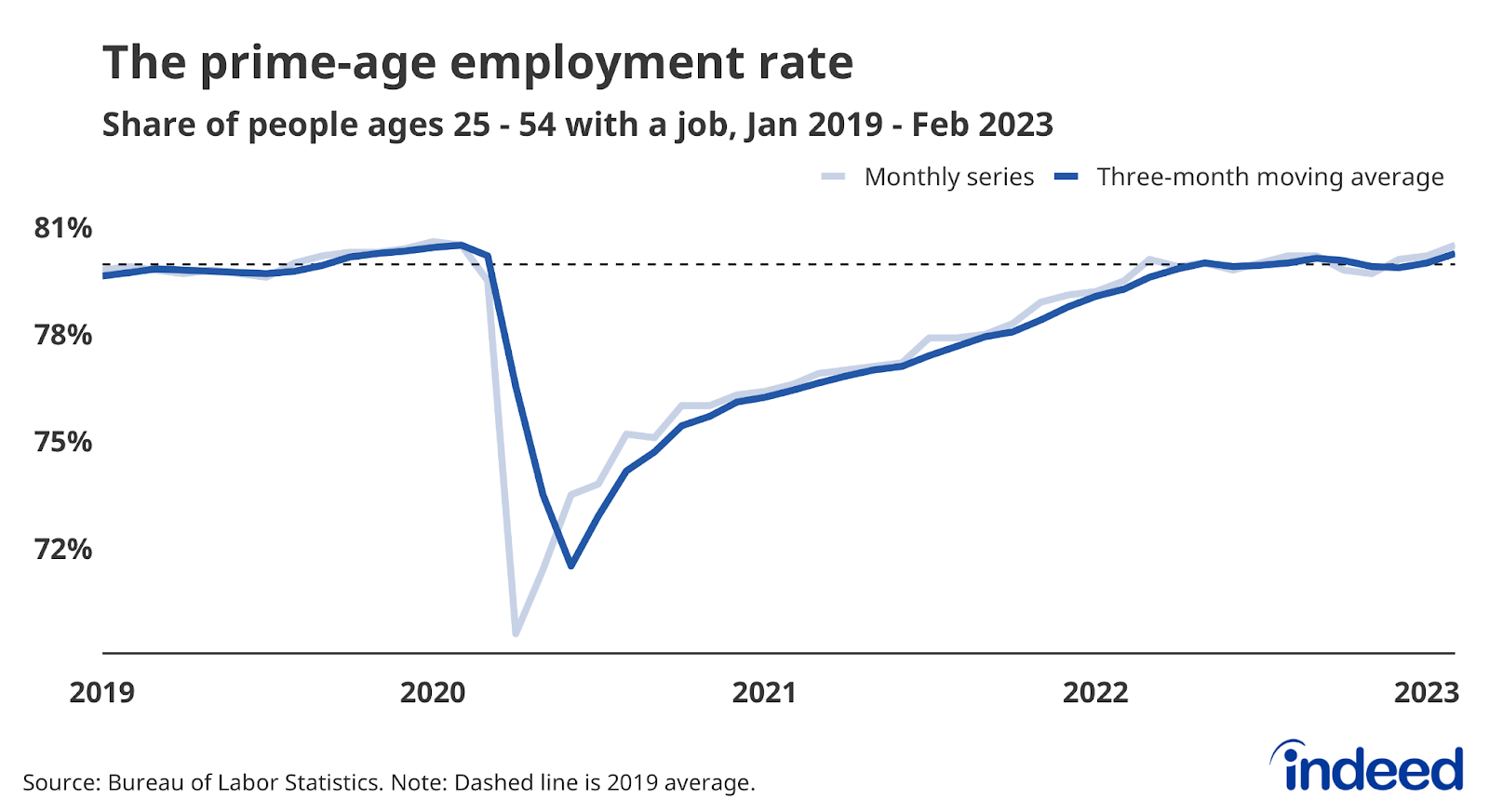

February 2025 Jobs Report A Path Toward Strong but Sustainable Growth? Indeed Hiring Lab, Maximum cpp2 contribution (employer and. Beginning january 1, 2025, you must deduct the second additional cpp contributions (cpp2) on earnings above the annual maximum pensionable earnings.

17 selfemployed tax deductions to lower your tax bill in 2025 QuickBooks, Earnings between $68,500 and $73,200 will be subject to additional cpp contributions, known as cpp2. Multiply your net earnings by 92.35% (0.9235) to get your tax base:

The Ultimate Guide to Tax Deductions for The SelfEmployed, For 2025, as in 2025, 2025, 2025, 2025, 2019 and 2018, there is no limitation on itemized deductions, as that limitation was eliminated by the tax cuts and jobs act. In 2025, the employment insurance (ei) premium rate for employees is 1.66% of insurable earnings, while employers’ premium rate is 2.320%.

SelfEmployment Tax Deductions (2025) Worksheets, Tax Calculator, Health Insurance Premiums, & More, Qualified business income (qbi) deduction; The amt exemption amount for tax year 2025 for single filers is $85,700 and begins to phase out at $609,350.

25 Self Employment Deductions Every Entrepreneur Should Check & Claim Internal Revenue Code, Key areas for deductions include home office. $50,000 x 92.35% = $46,175.

Australian Employment Projections to 2026 Career Revival, Multiply your net earnings by 92.35% (0.9235) to get your tax base: Credits, deductions and income reported on other forms or schedules.

Resources, Knowing the standard deduction amount for your filing status can help you determine whether you should take the standard deduction or itemize your deductions. For 2025, as in 2025, 2025, 2025, 2025, 2019 and 2018, there is no limitation on itemized deductions, as that limitation was eliminated by the tax cuts and jobs act.

3 tips for millennials filing taxes Artofit, Credits, deductions and income reported on other forms or schedules. Use the payroll deductions online calculator (pdoc) to calculate federal, provincial (except for quebec), and territorial payroll deductions.

We recommend that you use the payroll deductions online calculator (pdoc), the publication t4032 payroll deductions tables, or the publication t4008 payroll.

The Nature Conservancy Calendar 2025. We don't know when or if this item will be back in stock. The nature conservancy creates a calendar every year and sends them to many of our members and prospective members. Bring the outdoors in and celebrate tnc’s legacy club with these 2025 downloadable desktop calendars! Donate to support […]

Honda Civic 2025 Touring Price. There are five trim levels for the sedan: Research the ratings, prices, pictures, mpg and more. Lx $24,950 starting msrp * build. The price of the 2025 honda civic starts at $25,045 and goes up to $32,545 depending on the trim and options.

Casting Calls For Movies 2025. The mcu may only have one movie coming out in. Search for acting auditions in hollywood including film, television, commercials, theater, voiceover roles and more. All locations will be in the south east of england, predominantly, hertfordshire, north london and essex. Apply to nearly 10,000 casting calls and auditions on […]