Ira Income Limits 2025 For Simple Box. In 2025, the employee contribution limits to a simple ira are $16,000 for employees under 50 years old and $19,500 for employees 50 and older by the end of the calendar year. For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025.

The annual employee contribution limit for a simple ira is $16,000 in 2025 (an increase from $15,500 in 2025). Roth ira accounts are subject to income limits.

The ira contribution limits for 2025 are $6,500 for those under age 50 and $7,500 for those 50 and older.

In 2025, single filers making less than $161,000 and those married filing jointly making less than $240,000 can.

Roth Ira Limits 2025 Irs Sukey Stacey, Yes, 3 after 2 years: For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025.

2025 Contribution Limits Announced by the IRS, The maximum total annual contribution for all your iras combined is: Yes, 3 after 2 years:

Roth Ira Contribution Limits 2025 Over 50 Years Of Age Edith Heloise, The roth ira contribution limit for 2025 is $6,500 for those under 50, and $7,500 for those 50 and older. Employees 50 and older can make an extra $3,500.

Ira Contribution Limits 2025 Table Janka Lizette, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. The irs also increases the maximum income limits individuals must meet to be eligible to contribute to a roth ira in 2025, based on their income and filing status.

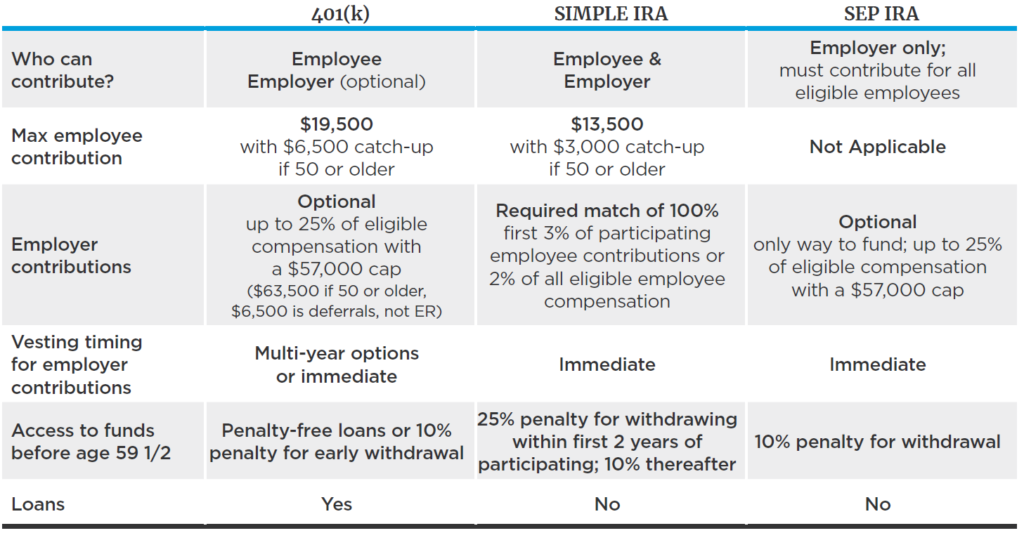

2025 ira contribution limits Inflation Protection, The irs also increases the maximum income limits individuals must meet to be eligible to contribute to a roth ira in 2025, based on their income and filing status. These contribution limits are lower than those for a.

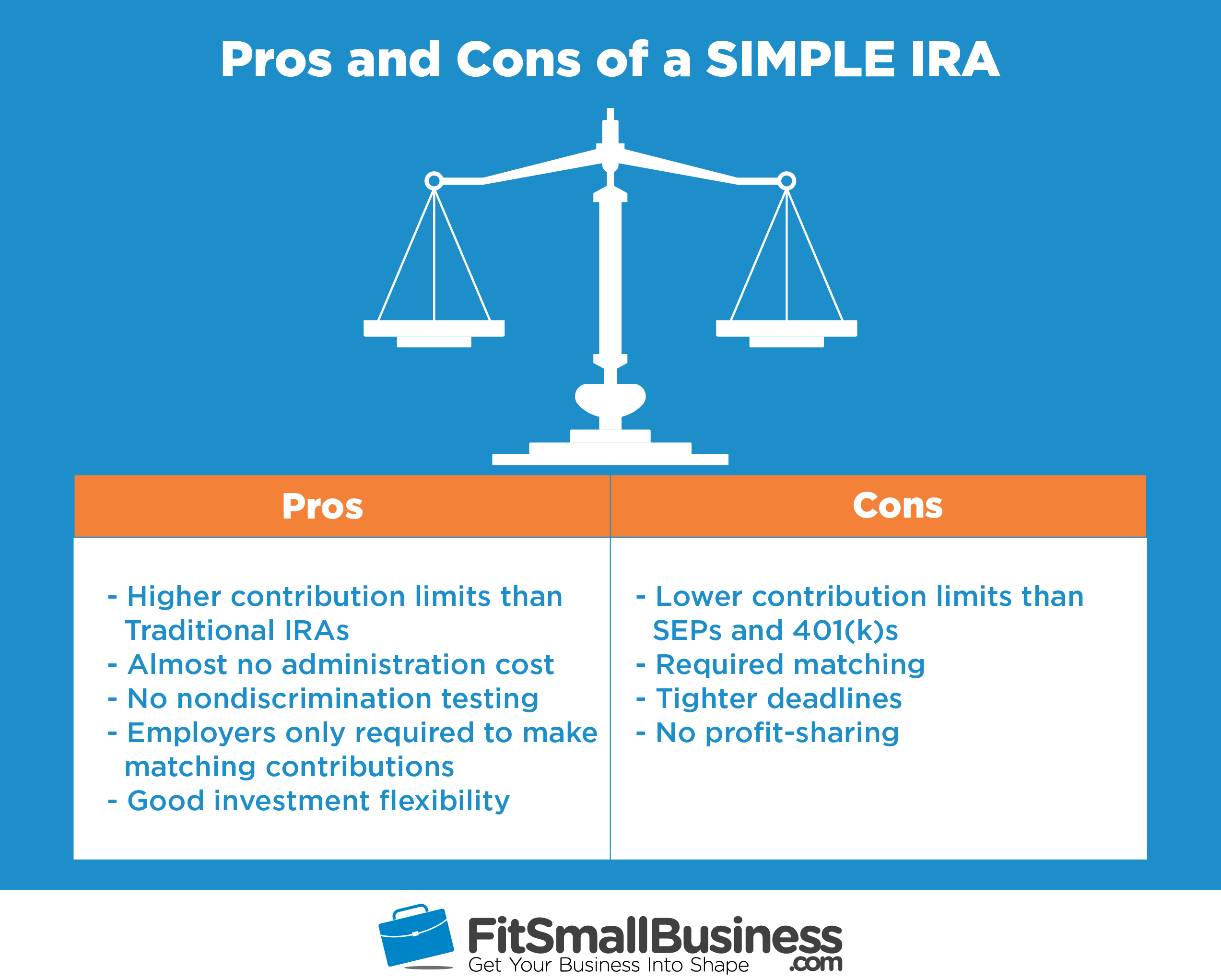

Ira Limits 2025 Mufi Tabina, A simple ira is an excellent tool for small business owners to help their employees save for retirement.this type of retirement account combines features of. In 2025, income limits are.

IRA Contribution Limits in 2025 Meld Financial, And for 2025, the roth ira contribution. The maximum amount you can contribute to a traditional ira or a roth ira in 2025 will be $7,000 (or 100% of your earned income, if less), up from $6,500 in 2025.

SIMPLE IRA Rules, Providers, Contribution Deadlines & Limits Small, Roth ira accounts are subject to income limits. The maximum amount you can contribute to a traditional ira or a roth ira in 2025 will be $7,000 (or 100% of your earned income, if less), up from $6,500 in 2025.

Irs Contribution Limits 2025 Bev Carolyne, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. The maximum amount you can contribute to a traditional ira or a roth ira in 2025 will be $7,000 (or 100% of your earned income, if less), up from $6,500 in 2025.

2025 Simple Ira Limit Roby Vinnie, These contribution limits are lower than those for a. For 2025, the ira contribution limits are $7,000 for those.